life insurance face amount decrease

Lower than reduced below minimum face amount requirements. Ad Compare the Best Life Insurance Providers.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

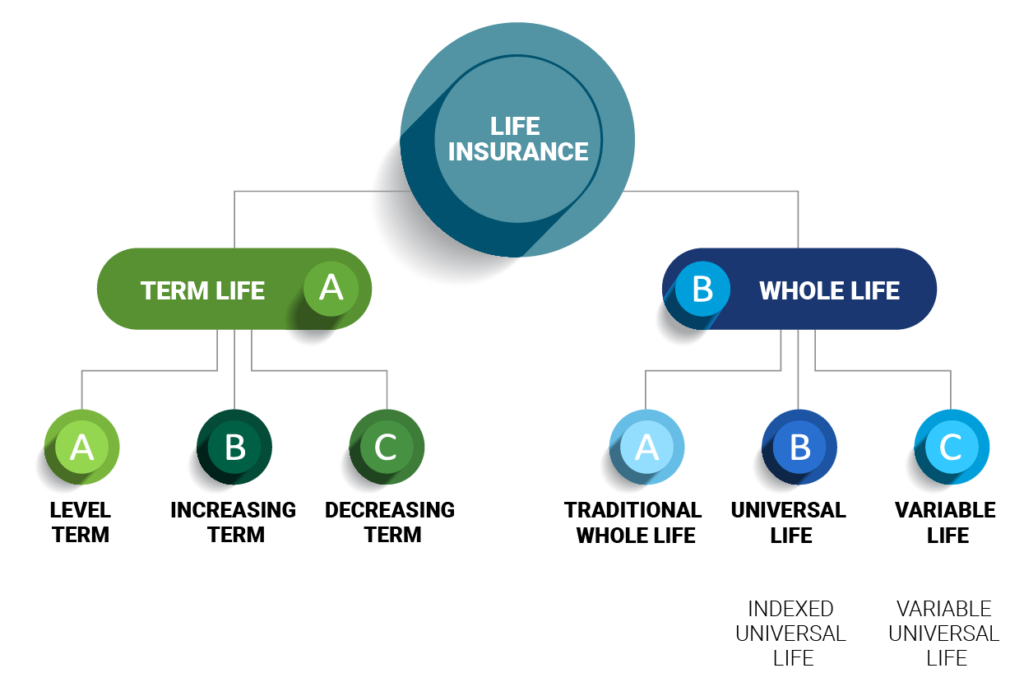

Variable Life Vs Variable Universal What S The Difference

The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

. Ad Shop The Best Rates From National Providers. The preceding tables describe life insurance coverage be-fore reductions are made due to age of the employee. It is used for life insurance policies.

The cash value is often stated on the top. If youre going from a 500000 policy to a 250000 policy dont expect to lower your term life insurance premium by cutting in exactly half. So if you buy a policy with a 500000 face value in most.

Updated Jul 26 2021. SelectQuote Rated 1 Term Life Sales Agency. Each year your decreasing term coverage will drop by a certain amount or percentage of the original payout.

Prudential Has The Life Insurance Options To Fit Your Needs. Universal Life Insurance UL Universal life insurance lets you make two choices which are as follows. What Dave Ramsey Says About The Difference Between Term and Whole Life Insurance.

This column illustrates how much you have to pay for the. Since it is clear that the face amount of the whole life policy is the death benefit or the original coverage the face amount is only paid after the policyholder dies. Ad Life Insurance Provides Peace Of Mind Knowing Youre Protecting People You Love.

3 Purchase a Less Expensive Policy. 6 Tips If Youre Having Trouble Paying Premiums. Term life plans typically come in lengths of 10 to 30 years.

Life Insurance Frequently Asked Questions Home Life Insurance. Zurich Changes in Specified Amount are allowed after the third policy year no more than one change is allowed in each. When the death benefit decreases and the amount it decreases by is set when you buy your policy.

Face amount is the gross total amount of cash quantified in an agreement or insurance policy. The face value of a life insurance policy is the death benefit. Level Death Benefit Beneficiaries will only get the face.

SelectQuote Rated 1 Term Life Sales Agency. 2 Reduce Your Premiums. A permanent policy with the.

Second apply the same principle to the term length of the coverage you purchase. If you own a whole life policy. Ad Shop The Best Rates From National Providers.

Yes it reduces the premium over time. If your mortgage will be paid off in five years you may not. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. Reviews Trusted by 45000000. Help Your Loved Ones with Funeral Costs Rent or Mortgage Payments Unpaid Bills and More.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. For example a person who seeks to buy a term life insurance policy from Company XYZ would expect to pay more for a 500000 face value policy than for a 100000 face value. Please pay attention to the column that says Net Premium Beg Year.

You can borrow or withdraw. Reduced paid-up insurance is a nonforfeiture option that whole life insurance companies provide to their policyholders. Reconsider the length of your policy.

Ac- cording to the 1984 survey plans covering 54 percent or 109 million of life. Call a licensed expert. Decreasing term insurance is a renewable term life insurance with coverage decreasing at a predetermined rate throughout the policys life.

Life Insurance Face Amount Sep 2021. Premiums consist of two things. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

Ad Easy Online Application with No Medical Exam Required Just Health and Other Information. Insurer will absorb the cash value of your whole life insurance policy after you die and your beneficiary will get the death benefit. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

Decreasing term coverage usually lasts 5 to 30 years. The face value of life insurance is equivalent to the death benefit you select when purchasing a policy. Ad Know the Difference Between Term Life and Whole Life Insurance and Learn Which is Better.

Normally the face amount is a round number like. 1 Reduce the Face Value of Your Policy. Face value is different from cash value which is the amount you receive when you surrender your.

For example the initial face amount of coverage of a 200000 decreasing term life insurance policy decreases by 20000 each year until after 10 years the face value of the. This Policy Change content is for Term Life products issued between 2013 to 2017.

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Increasing Term Insurance Explained Policy Advice

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

How To Lower Your Life Insurance Premium

Annuity Vs Life Insurance Similar Contracts Different Goals

New York Life Insurance Review Whole And Universal Life Valuepenguin

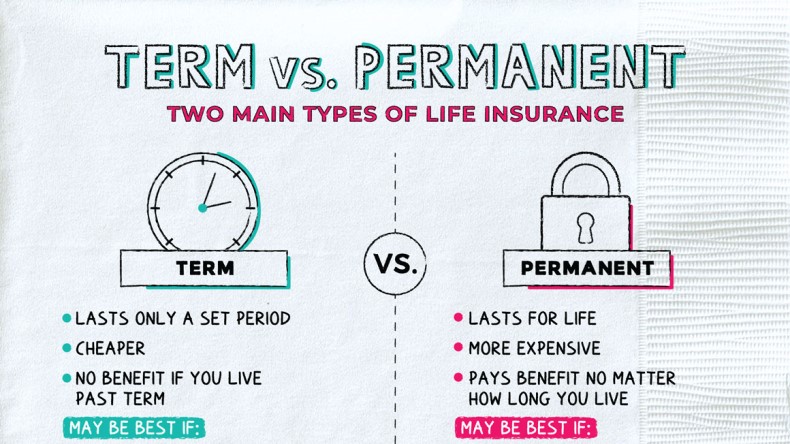

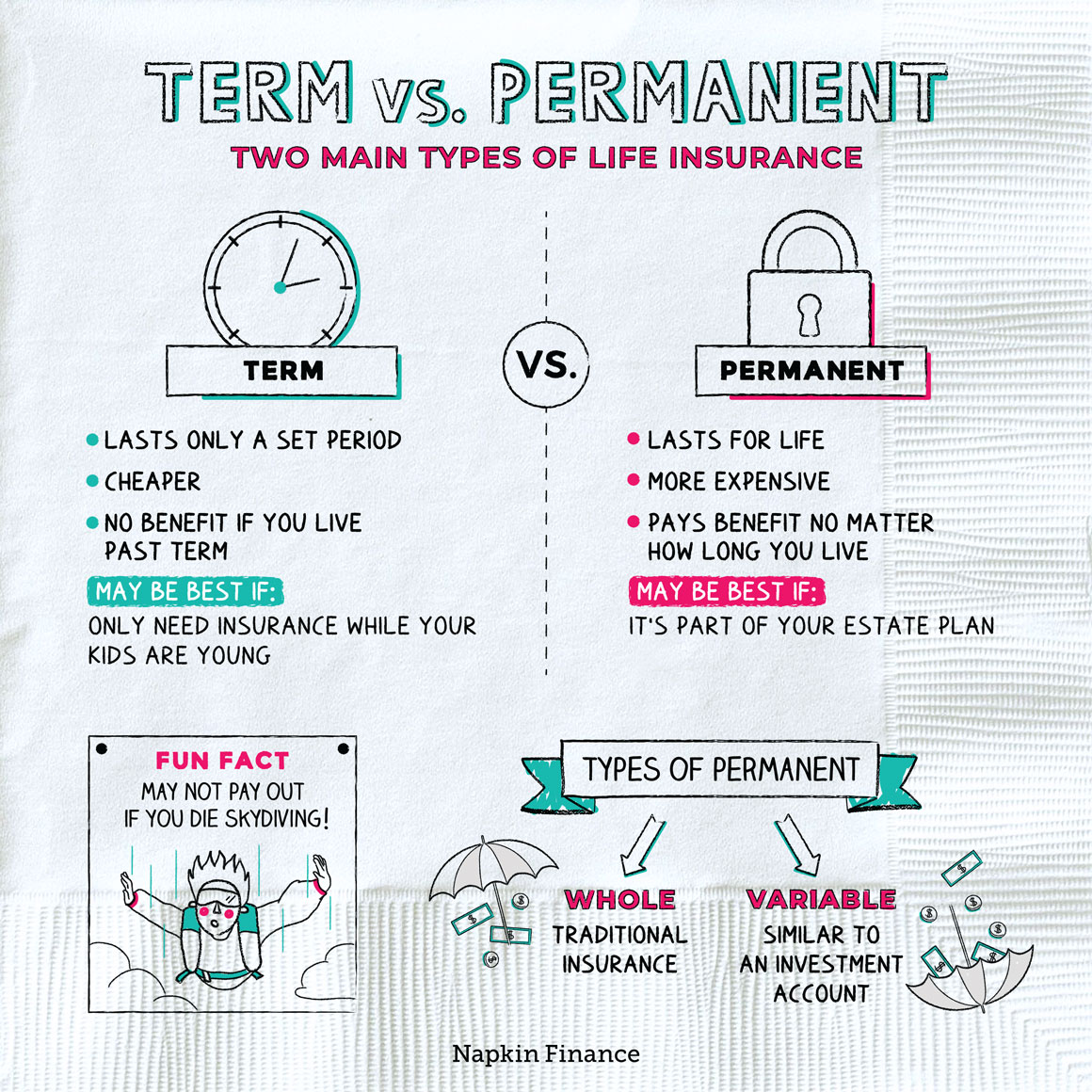

Term Vs Permanent Life Insurance Napkin Finance

When Is Life Insurance An Asset Smartasset

Glossary Of Life Insurance Terms Smartasset Com

What Is Whole Life Insurance Cost Types Faqs

Indexed Universal Life Insurance 2022 Definitive Guide

Adjustable Life Insurance Pros Cons Of Flexible Premiums Valuepenguin

How Does Adhd Affect Life Insurance Rates Quickquote

Insurance With Potential Cash Value Articles Consumers Credit Union

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

How Does Adhd Affect Life Insurance Rates Quickquote